Best Does Not Mean Optimal

Best Does Not Mean Optimal

By Joachim Klement, CFA Posted In: Behavioral Finance, Drivers of Value, Economics, Leadership, Management & Communication Skills, Portfolio ManagementI recently had yet another discussion with an investment professional who attempted to describe how they are trying to build the optimal portfolio for their clients. In this case, the conversation was with an investment consultant, but I have also had them with institutional portfolio managers and wealth managers.

What always irks me is how they all talk about creating the best portfolio for their clients, but in the same sentence stress that they do this by creating the optimal portfolio.

But who says that the “best portfolio” equals the “optimal portfolio”?

In theory, the optimal portfolio is the best portfolio, but in reality, the optimal is often far from the best for any given investor. Or to recall a quote variously attributed to Albert Einstein, Yogi Berra, and Richard Feynman, among others: “In theory, there is no difference between theory and practice, while in practice there is.”

The problem with optimal solutions in the investment world is that they are very sensitive to the input parameters. A Markowitz portfolio optimization is about 10 times more sensitive to the return assumptions than the volatility assumptions and about 100 times more sensitive to the return assumptions than the correlation assumptions. In practice, however, returns are much harder to predict than volatility or correlation, and the estimation errors associated with return forecasts are so large that we’d need thousands of years of data to reliably calculate the optimal portfolio in practice.

I wrote a lengthy paper on this problem a while back that was inspired by the then-new results that a simple equal-weighted portfolio of assets significantly outperforms almost all portfolio optimization methods out of sample. And in a recent Long View post, I explained why, even in the long run, estimation errors for return forecasts persist and do not decline as the investment horizon lengthens.

Yet, so many consultants, chief investment officers (CIOs), and wealth managers insist on optimizing a portfolio based on a set of assumptions about the future. This exposes the portfolio manager to a major challenge when interacting with beneficial owners and clients: The portfolio optimization process is a black box.

Trustees of pension funds and private investors tend to be laypeople, not experts in finance and portfolio theory. So communication between the portfolio manager and client usually involves long explanations as to why equities should return, say, 10%, bonds 3%, and hedge funds 5%, etc. Then some hand waving occurs and the final portfolio is presented as the optimal solution for the client. But the client never understands how these assumptions lead to the proposed allocation. And what that means is that once the realized portfolio returns fail to meet expectations, clients quickly try to abandon the black box in favor of another portfolio.

At a previous employer, we measured the average client investment period in multi-asset portfolios with different strategic asset allocations. It turned out to be around 18 months. So once every year and a half, the average client would switch from one strategic asset allocation to another. The outcome for investors was worse performance in the long run than if they had just stuck with a specific strategy.

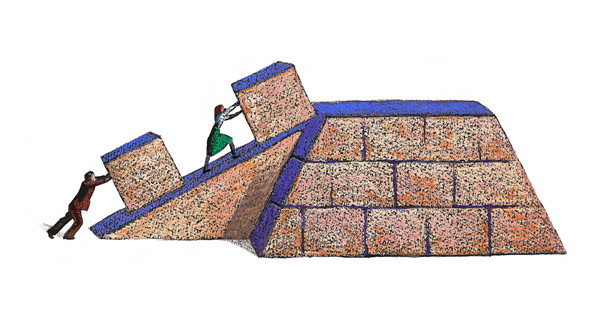

But since clients do not grasp the purpose of each investment in the context of the overall portfolio, they are more likely to give up on the portfolio, or parts of it, in times of trouble. As a result, the best portfolio is not the optimal portfolio, but rather the one that the client can stick with through the market’s ups and downs. This means reframing the role of different asset classes or funds relative to the investor’s goals and sophistication rather than to volatility and return.

The goal of equities — or private equity — in a portfolio, for example, is to grow wealth in the long run. To achieve this, investors must feel safe enough to stay with the strategy even if equities decline by 20% to 50%, which they might well do during a bear market. This sense of security can only be created by holding enough cash and government bonds to guarantee (!) that clients can meet their obligations for many years while the equity portfolio recovers.

Safe investments with low returns can be augmented by income-producing or inflation-linked investments like property or infrastructure. These investments protect against loss of purchasing power through inflation and provide additional income that can be used to pay for ongoing expenses.

In the pension fund world, this kind of thought process has led to liability-driven investments that cover a predictable set of cash flows for the coming decades. Assets that are not needed to cover a predictable liability profile can then be invested in equities and other growth assets to increase the asset base relative to the long-run liabilities.

In the world of private wealth management, approaches like Ashvin B. Chhabra’s three dimensions of risk have long been discussed and occasionally implemented by boutique firms. Yet for reasons I still cannot understand, these strategies have never entered the mainstream. In my experience, such behavioral approaches to portfolio construction work much better in practice than black box “optimal portfolios.”

Consultants, portfolio managers, and wealth managers who take their fiduciary duty seriously should seriously consider ditching their “optimal portfolios” in favor of these theoretically less optimal but practically more robust solutions.

Because you are not acting in the client’s best interest if you build them a portfolio that they won’t stick with over the long term.

For more from Joachim Klement, CFA, don’t miss Risk Profiling and Tolerance: Insights for the Private Wealth Manager, published by the CFA Institute Research Foundation.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/Jonathan Evans