Weekend Reads: Upside Down Edition

Weekend Reads: Upside Down Edition

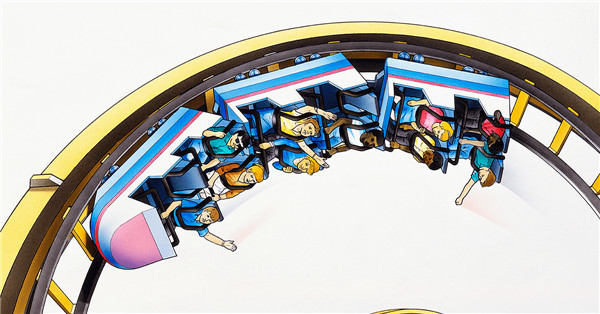

By Jason Voss, CFA Posted In: Behavioral Finance, Economics, Equity Investments, Fixed Income, History & Geopolitics, Investment Topics, Portfolio Management, Weekend ReadsLet’s jump straight into the articles this month. The theme of this edition? Surprises of the upside-down variety.

Investing

When I was in graduate school for business, one important takeaway from my two-year education was that mergers and acquisitions almost never add value. Parenthetically, I have for many years reminded those who make this point that there is no control case — no way to know how the acquirer and acquiree would have performed had the merger not taken place. Nonetheless, I believe that M&As are almost always defensive in nature and reflect unimaginative management desperately kowtowing to short-term shareholders. The disastrous acquisition of Baker Hughes by General Electric backs up this claim. GE, of course, wants to turn this transaction upside down.

Economics

Long-time readers know that I have criticized the huge levering up by US businesses in the aftermath of the Great Recession. Now, what happens when interest rates are on the rise and the debt coming due needs to be refinanced? Hmmm. Clearly net income is going to suffer. If the debt is just retired, then cash flows will be depleted and opportunities to earn higher rates of return through strategic and tactical allocations of capital reduced. Share buybacks will be fewer. And on and on. In other words, the financial performance boost underwritten by central banks is now being turned upside down . . . and so, seemingly, is the yield curve.

Who would ever have predicted that the conservative leader of a major global economy, one with a background in business, would lead the charge for global protectionism? Of course, I am referring to the current upside-down trade policy of the United States. Among the protectionist moves undertaken: walking away from the Trans-Pacific Partnership (TPP). While the United States engages in domestic navel-gazing, Japan and the European Union inked a trade deal that accounts for 30% of global GDP.

Some economists have trumpeted a productivity slowdown in the global economy. No doubt you have seen this data, too. Could sleep deprivation be one of the culprits? I certainly feel my world is upside down when I sleep poorly.

A fascinating essay on Adam Smith by the author of a recent biography on the supposed godfather of economics closes out this section. It turns out that Smith is frequently misquoted and misunderstood by supporters and detractors, alike. You guessed it: Folks get Smith upside down. This, by the way, is a mid-year choice for story of the year.

Behavioral Finance

Speaking of stories of the year, according to the Pew Research Center, Americans have trouble recognizing facts in news stories. Only one out of four US adults could distinguish the factual statements from the opinions in a selection of news articles. I would bet that the United States is not the only nation whose people are bamboozled by opinion masquerading as fact. That the facts are no longer seen as, well, facts is the ultimate in upside down.

Fintech

I believe that artificial intelligence (AI) and its cousin, machine learning, are very interesting extensions of the Industrial Revolution. In the Industrial Revolution, the functional specialization of work was all the rage, despite humanity’s gift at applying radically flexible general intelligence. Now that the owners of capital have had us specializing in our work for two centuries and computing and electronics have grown sophisticated enough, the creation of machines that do hyperspecialized work more quickly and more accurately than us is the ultimate coup.

Still, most do not perceive AI or machine learning in this way. Instead, they display the representativeness behavioral bias: They take AI’s excellent performance in one domain and simply extrapolate that to ALL endeavors, and conclude that AI will supplant human intelligence. Meanwhile, they fail to recognize that specialized excellence is not the only way to create value in an economy. There is something to be said for understanding the whole of a system and creating new ways of doing things that are radical context breakers. Many in the AI and machine learning community are beginning to recognize the lack of general intelligence of these master machines and are starting to ask if there is a smarter path to deep learning.

Current AI applications crunch huge amounts of data behind the scenes for the benefit of the end user. But what if there was a better way of solving these equations that could dramatically reduce computational grunt work?

Last on this subject, commentators in Japan are worried that the rise in automated manufacturing may pose a slavery risk for Asian workers. This is a perfect demonstration of the current zeitgeist about AI and machine learning. What we need, folks, is a better understanding of human intelligence and what it does well before we abandon it altogether. The implications are gigantic and widespread and affect everything from how we raise our children, educate ourselves, deploy capital, manage governments, live our lives, and on and on. Not enough attention is paid to this alternative point of view at the moment.

Environment, Social, and Governance (ESG)

A new study finds that in the United States, methane emissions resulting from the poor management of oil and nature gas infrastructure are the greenhouse gas equivalent of all carbon dioxide emissions from the US coal industry. Yuck!

Fun Stuff

This edition of Weekend Reads features no “fun stuff.” In lieu of that, I send my sincerest wishes for an excellent summer to those of you in the Northern Hemisphere and for an easy winter to those of you in the Southern Hemisphere.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/Dorling Kindersley